Loading

Get Ga Non-foreign Affidavit Under Internal Revenue Code 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA Non-Foreign Affidavit Under Internal Revenue Code online

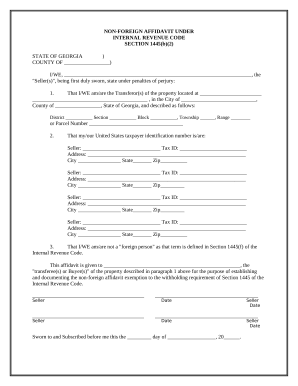

The GA Non-Foreign Affidavit Under Internal Revenue Code is a crucial document for individuals involved in real estate transactions in Georgia. This guide will walk you through the process of completing this affidavit online, ensuring you understand each section and field.

Follow the steps to successfully complete the affidavit online.

- Click the ‘Get Form’ button to access the form and open it for editing.

- In the first section, you will need to provide the names of the sellers in the designated fields. Ensure that the information accurately reflects the individuals involved in the transaction.

- Fill in the address of the property being transferred. This includes the city, county, and a detailed description of the property such as the district, section, block, township, and range or parcel number.

- Next, enter the tax identification numbers for each seller. It's essential to ensure accuracy in this section as it relates to tax responsibilities.

- Confirm the status of the sellers by indicating that they are not classified as 'foreign persons' as defined by the Internal Revenue Code. This statement is crucial for the exemption from withholding requirements.

- Include the name of the transferee or buyer in the specified field. This helps to identify the individual or entity benefiting from the affidavit.

- Lastly, review the entire document for accuracy and completeness. Once satisfied, you can save changes, download, print, or share the form as needed.

Complete your GA Non-Foreign Affidavit online today for a seamless real estate transaction.

To ensure collection of the FIRPTA tax, any transferee or buyer acquiring a U.S. property interest must deduct and withhold a tax equal to 15 percent of the amount realized on the disposition.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.