Loading

Get Application Forms - Bureau Of Internal ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application Forms - Bureau Of Internal Revenue online

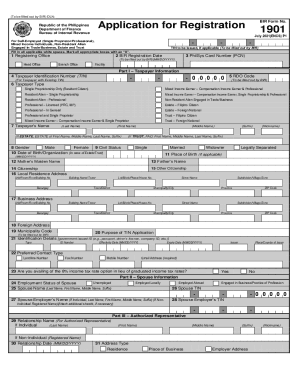

This guide serves to assist users in completing the Application Forms required by the Bureau of Internal Revenue online. It provides detailed, step-by-step instructions tailored for individuals, including those with limited legal experience.

Follow the steps to fill out the Application Forms online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin with the registering office section, where applicable spaces need to be filled in. Provide your Taxpayer Identification Number (TIN) if you have one.

- Indicate the BIR registration date and PhilSys Card Number if required.

- In Part I – Taxpayer Information, provide your TIN for existing taxpayers, RDO code, and select your taxpayer type from the provided options.

- Enter taxpayer's name (last name, first name, middle name) and complete the fields regarding gender, civil status, and date of birth.

- Fill in additional information such as parents’ names and local residence address, ensuring all required boxes are accurately marked.

- Complete business address and any foreign address information if applicable.

- In the purpose of TIN application section, select the reason for applying and provide identification details including ID type and number.

- Indicate your preferred contact method, including mobile number and email address.

- Proceed to fill in spouse information, if applicable, followed by the details of the authorized representative section.

- Complete business information including business registration details and if applicable, incentive details offered to your enterprise.

- In Part VII, provide information regarding BIR printed receipts and invoices, ensuring to submit any required documents.

- Finally, review your entries for accuracy, save the form, and choose whether to download, print, or share the completed document.

Take the first step towards registration by filling out your application form online today.

Related links form

What is this form? BIR Form 2307, or Certificate of Creditable Tax Withheld at Source is a tax certificate which needs to be accomplished by the withholding agent which shows the recipient of any income subject to expanded withholding tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.