Loading

Get Global Tax Guide To Doing Business In The United Kingdom

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Global Tax Guide To Doing Business In The United Kingdom online

This guide provides a comprehensive overview for users on how to successfully fill out the Global Tax Guide To Doing Business In The United Kingdom. It outlines essential steps to ensure all necessary information is accurately completed online, streamlining the filing process.

Follow the steps to effectively complete the Global Tax Guide online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

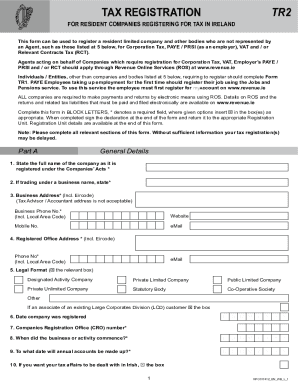

- Review the general details section of the form, which includes fields for the full name of the company, business name (if applicable), business address including Eircode, and contact information. Ensure all required fields marked with an asterisk are filled out accurately.

- Complete the legal format section by selecting the appropriate legal structure of your business, such as Private Limited Company or Public Limited Company. This helps define your company's regulatory obligations.

- Provide the date of company registration and the commencement date of business activities. These dates are crucial for taxation purposes.

- Detail any previous tax registrations if applicable, including Corporation Tax and VAT. This information helps establish your company's tax history

- Indicate the anticipated online sales percentage and provide your website address to evaluate your online business presence.

- Classify your business type, such as retail or manufacturing, and provide a thorough description of the business activities you engage in.

- Share expected turnover for the next 12 months, allowing tax authorities to assess your business scale.

- If applicable, provide details about any software packages being used for accounting purposes, enhancing your ability to manage finances orderly.

- Complete sections regarding employees and payroll, noting the employment type and payroll systems you will implement.

- Finally, after filling out all required sections, review the form for accuracy, and then save any changes. You may download, print, or share the completed form as required.

Complete your Global Tax Guide online today and manage your tax affairs efficiently.

You'll start paying income tax once your profit goes above your personal tax allowance, which is £12,570 in 2023. If you're a company director of a small business, you pay income tax on any salary you take from the business, and you'll pay tax ing to the same tax thresholds as any employee in a company.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.