Loading

Get Tx Tdecu Direct Deposit Form 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX TDECU Direct Deposit Form online

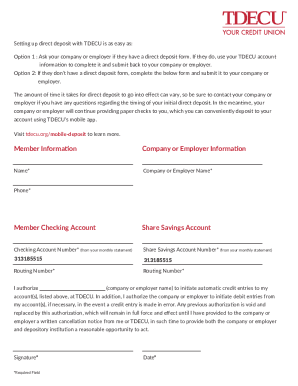

Setting up direct deposit with TDECU is essential for convenient banking. This guide will provide clear instructions on how to fill out the TX TDECU Direct Deposit Form online, ensuring a seamless process for users.

Follow the steps to complete the TX TDECU Direct Deposit Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your member information. Fill out your name and any other required personal details as indicated on the form.

- Next, provide your company or employer information. Fill in the company or employer name along with their contact phone number.

- Move on to the member checking account details. Enter your checking account number as shown on your monthly statement.

- Similarly, input your share savings account number, which can also be found on your monthly statement.

- Now, enter your routing number. This number is crucial for processing the direct deposit transactions.

- Authorize the company or employer by specifying their name in the designated area. This step indicates that they can initiate automatic credit entries to your TDECU accounts.

- Sign in the designated area to confirm your authorization. Ensure that your signature is clear, as it is required for processing.

- Lastly, enter the date of signing the form. This is important for record-keeping purposes.

- Once you have filled out all the required fields, review the information for accuracy. You can then save changes, download, print, or share the completed form as needed.

Complete your TX TDECU Direct Deposit Form online today to enjoy the convenience of direct deposit!

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.