Loading

Get Tx 01-925 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 01-925 online

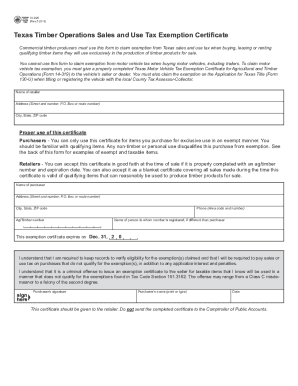

The TX 01-925 form is essential for commercial timber producers seeking to claim exemptions from Texas sales and use tax on qualifying timber items. This guide offers clear, step-by-step instructions for effectively completing the form online.

Follow the steps to complete the TX 01-925 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the name of the retailer from whom you are purchasing the timber items. Make sure to fill in their complete address, including street and number, city, state, and ZIP code.

- Next, provide your information as the purchaser. Include your name, complete address, and ag/timber number. It's important that this information is accurate as it verifies your eligibility for the exemption.

- If applicable, indicate the name of the person to whom the ag/timber number is registered if different from the purchaser. Additionally, disclose a contact phone number for easy communication.

- Review the understanding clause carefully. By signing, you acknowledge your obligation to maintain records that verify eligibility for the exemption and that any misuse could lead to penalties.

- Provide your signature, print or type your name, and date the form to validate it.

- After completing the form, you may choose to save your changes. You can also download, print, or share the completed certificate as needed. Remember, this certificate should be given directly to the retailer; do not send it to the Comptroller of Public Accounts.

Complete your TX 01-925 online today to take advantage of your sales and use tax exemptions.

A homestead exemption in Texas is a tax break applied to your primary residence. It can lower your property taxes by exempting a portion of the value of your home from taxation. The amount of the exemption varies depending on the county in which you live, but it can be up to 20% of the appraised value of your home.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.