Loading

Get Md Form 510e 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Form 510E online

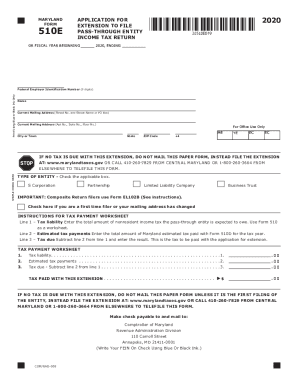

Filling out the MD Form 510E online can help simplify the process of applying for an extension to file a pass-through entity income tax return. This guide provides clear and supportive instructions to help users navigate each section of the form confidently.

Follow the steps to complete the MD Form 510E.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the federal employer identification number (9 digits) in the designated field. If you have not secured a FEIN, write 'APPLIED FOR' and include the date of application.

- Provide the name of the pass-through entity in the appropriate area. Continue with any 'Trading As' name, if applicable.

- Fill in the current mailing address, ensuring you include the street number, street name, apartment or suite number, city or town, state, and ZIP code.

- Indicate the type of entity by checking the applicable box, such as S corporation, partnership, limited liability company, or business trust.

- Complete the tax payment worksheet by entering your expected tax liability, estimated tax payments made in the current year, and calculating the tax due.

- If your tax due is zero, you may telefile or file online. If you have any tax due, ensure to make your payment along with the completed form.

- Review all entered information for accuracy before saving changes or proceeding with the submission.

- Once you complete the form, my options include saving the changes, downloading a copy, printing the form, or sharing it as needed.

Complete your MD Form 510E online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Generally, taxpayers should file with the jurisdiction in which they live. If you live in Maryland, file with Maryland. If you live in Washington, D.C., Pennsylvania, Virginia or West Virginia, you should file with your home state.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.