Loading

Get Tx 05-139 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 05-139 online

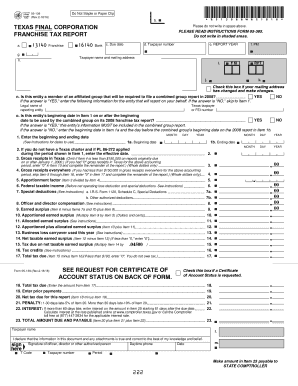

Filling out the TX 05-139 form online can streamline your experience and ensure accuracy in reporting your franchise tax information. This guide will provide you with a comprehensive walkthrough of each section of the form, tailored for users with varying levels of experience.

Follow the steps to successfully complete and submit your TX 05-139 form online.

- Use the ‘Get Form’ button to access the TX 05-139 form and open it in your online editor.

- Fill in the due date, taxpayer number, and report year in the specified fields at the top of the form.

- Enter your full taxpayer name and mailing address in the designated section. If your mailing address has changed, check the box and update your information.

- Indicate whether your entity is part of a combined group by selecting 'Yes' or 'No' and provide the reporting entity’s details if applicable.

- In Item 1, input the beginning and ending dates of your reporting period.

- Complete Items 2 to 4 with your gross receipts information as applicable. If gross receipts are below the threshold, skip the relevant sections.

- Fill out the financial information related to federal taxable income, deductions, officer and director compensation, and earned surplus in Items 5 to 14.

- Calculate your net taxable earned surplus and tax due in Items 14 and 15, respectively.

- Complete items related to penalties and interest if applicable, ensuring all calculations are accurate.

- Review your entries in each section for accuracy, then save your changes.

- Once completed, download, print, or share the form as required, and ensure to follow submission instructions provided.

Complete your TX 05-139 form online today for a seamless filing experience.

Extension to File Taxes in Texas for 2023 You must send payment for taxes in Texas for the fiscal year 2023 by May 15, 2024. The Extension Deadline is November 15, 2024 to file your Texas Individual Income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.