Loading

Get Mn Mw5 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN MW5 online

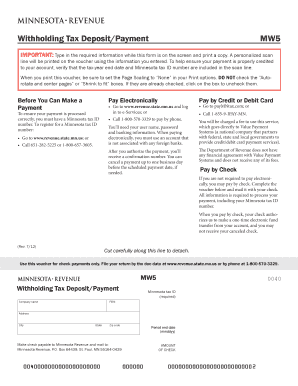

Filling out the MN MW5 form, which is used for Withholding Tax Deposit/Payment, can be straightforward if you follow a guided approach. This document management guide aims to provide you with clear instructions on how to complete the form accurately and efficiently.

Follow the steps to properly complete the MN MW5 form.

- Press the 'Get Form' button to access the MN MW5 form and open it in your preferred document editor.

- Begin filling in the required information, such as the company name, Minnesota tax ID number, and the Federal Employer Identification Number (FEIN) if applicable.

- Enter the last day of the applicable tax period in the specified format (mmddyy), either for quarterly or annual filings. Ensure that this information is accurate to avoid processing issues.

- Provide your complete address, including city, state, and zip code, to ensure that the Department of Revenue can contact you if necessary.

- Make sure to verify that the tax-year end date and Minnesota tax ID number are included in the printed scan line for proper payment credit.

- Once all information is completed, choose to save changes, and you can then download, print, or share the form with the appropriate payment method.

Complete your MN MW5 form online to ensure timely processing of your withholding tax payments.

Related links form

In order to decide how many allowances you can claim, you need to consider your situation. A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.