Loading

Get Az Form 450 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Form 450 online

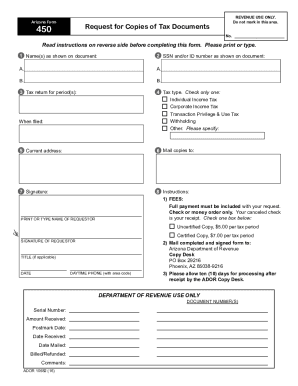

Filling out the AZ Form 450 online can streamline your request for copies of tax documents. This guide provides you with a step-by-step approach to ensure that you complete the form correctly and efficiently.

Follow the steps to fill out the AZ Form 450 online

- Press the ‘Get Form’ button to obtain the AZ Form 450 and open it in your online editor.

- Enter the name(s) as shown on the document in the first section. If this request is for an individual income tax document, include the taxpayer's full name. If married, input the spouse's name on line B.

- Input the Social Security Number (SSN) or identification number as shown on the document in the second section. For individual requests, input the taxpayer's SSN. If applicable, include the spouse's SSN on line B.

- Specify the tax return for the period(s) needed in section three. This can involve entering the year and date the document was filed.

- In the fourth section, select the type of tax you are requesting by checking only one box for Individual Income Tax, Corporate Income Tax, Transaction Privilege & Use Tax, Withholding, or other. Use a separate form for each tax type.

- Fill in your current address, which is required in section five. If sending copies to a different address, provide that information in section six.

- Sign and date your request in section seven. For business-related requests, include your title. The form cannot be processed without a signature.

- In the final section, choose the type of copy you want: Uncertified ($5.00) or Certified ($7.00) per tax period. Remember that full payment must accompany your request, and only check or money order is accepted.

- After completing the form, save your changes. You can download, print, or share the form as needed before mailing it to the Arizona Department of Revenue.

Complete your AZ Form 450 online today for efficient processing.

Individuals can find all tax forms and instructions on the ADOR website or visit our local offices. Please note that the Arizona tax package and Arizona Booklet X Volumes 1, 2, and 3 are now available to download from our website. Taxpayers can also find fillable and non-fillable tax forms online.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.