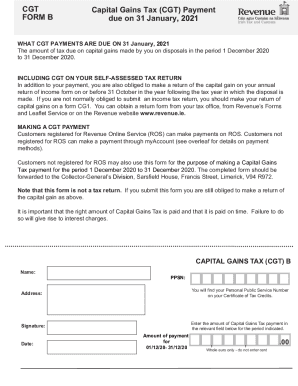

Get Ie Cgt Form B 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:Feel all the advantages of submitting and completing forms on the internet. Using our service filling in IE CGT Form B only takes a few minutes. We make that achievable by giving you access to our full-fledged editor effective at altering/fixing a document?s original text, inserting unique fields, and putting your signature on.

Execute IE CGT Form B within a few moments following the recommendations listed below:

- Pick the template you will need from the collection of legal forms.

- Click the Get form key to open the document and start editing.

- Complete all of the required boxes (these are marked in yellow).

- The Signature Wizard will allow you to put your e-signature after you have finished imputing information.

- Add the relevant date.

- Double-check the entire document to make certain you have filled in all the information and no corrections are needed.

- Hit Done and save the filled out form to your computer.

Send your IE CGT Form B in an electronic form right after you are done with filling it out. Your data is securely protected, as we adhere to the most up-to-date security criteria. Become one of numerous satisfied clients that are already completing legal documents from their homes.

You don't incur LTCG tax on capital gains from ELSS up to Rs 1 lakh. However, you have to pay long-term capital gains tax on (Rs 1,50,000 – Rs 1,00,000) Rs 50,000 at 10%. You will incur an LTCG tax of Rs 5,000 (10% of Rs 50,000) on your capital gains from ELSS.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.