Loading

Get Ca Soc 860 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA SOC 860 online

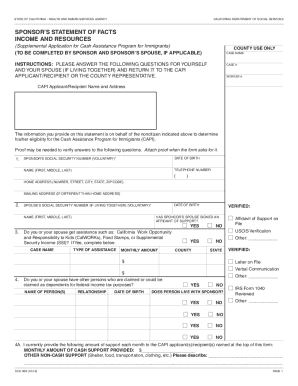

The CA SOC 860 is a vital document used to determine eligibility for the Cash Assistance Program for Immigrants in California. This guide will provide clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to complete the CA SOC 860 effectively.

- Press the ‘Get Form’ button to access the CA SOC 860 and open it in your editor.

- Begin filling out the form with the required personal information in the designated fields, including your social security number (if applicable), date of birth, and contact details.

- Next, provide the same information for your spouse if you are living together, including their social security number and date of birth. Indicate if your spouse has signed an Affidavit of Support.

- Respond to questions regarding assistance received by you or your spouse, such as CalWORKs or Food Stamps. Provide verification details, including case names and monthly amounts.

- List any dependents for whom you or your spouse claim on your income taxes and indicate their relationship and date of birth.

- Indicate any current employment or self-employment status, and provide relevant income details, ensuring to attach any necessary proof of income.

- Answer questions about additional income sources, such as Social Security benefits or child support, and provide the required information.

- Detail any resources owned by you or your spouse, such as bank accounts, real property, and vehicles. Provide current values and attach supporting documentation if required.

- Review all the provided information for accuracy. Make sure to include your signature, the signature of your spouse (if applicable), and any required witness signatures.

- Once completed, save your changes, download the form for your records, and print or share as necessary.

Complete your documents online with confidence and ensure timely submission for the Cash Assistance Program for Immigrants.

Anyone who is convicted of making a false or a misleading statement to obtain welfare benefits can be charged in California with a misdemeanor. A conviction is punishable by up to six months in jail and/or a fine of up to $500.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.