Loading

Get Ga Business Personal Property Tax Return - Fulton County 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA Business Personal Property Tax Return - Fulton County online

Completing the GA Business Personal Property Tax Return is an essential process for businesses in Fulton County. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently online.

Follow the steps to successfully complete your tax return.

- Click ‘Get Form’ button to obtain the tax return form and open it for editing.

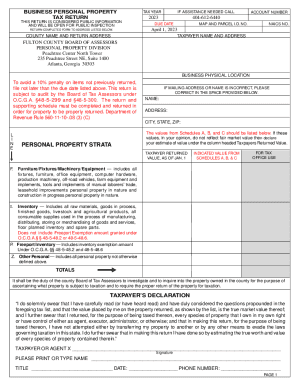

- Provide the tax year and account number at the top of the form. Ensure to enter the correct information for the tax year you are reporting, which is 2023.

- Fill in the taxpayer name and address section. If there are any mistakes in the provided information, correct them in the space provided.

- Complete the general information section by checking the appropriate type of business, type of income tax filed, and fiscal year ending date. Ensure that all requested details are filled accurately.

- Provide your federal employer identification number and state taxpayer identification number. This information is crucial for identification purposes.

- In the personal property strata section, gather values from Schedules A, B, and C and list them under the respective categories. Ensure that these values reflect fair market value.

- For the taxpayer's declaration, read the declaration statement carefully, then sign and date the form. Make sure to print or type your name and title for clarity.

- After completing the form, review all entries to ensure accuracy. Save your changes, and consider downloading or printing the completed form for your records.

- Once confirmed, submit the completed form as instructed, ensuring it is sent to the Fulton County Board of Assessors by the due date to avoid penalties.

Start filling out your GA Business Personal Property Tax Return online now to ensure compliance and avoid late penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

All property in Georgia is taxed at an assessment rate of 40% of its full market value. Exemptions, such as a homestead exemption, reduce the taxable value of your property.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.