Loading

Get Ca Std 699 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA STD 699 online

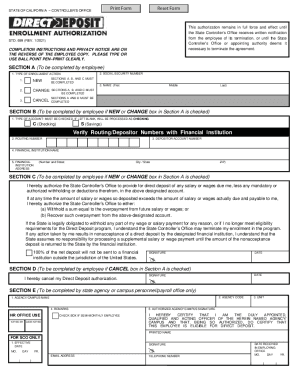

Filling out the CA STD 699 form online is essential for enrolling in the Direct Deposit program with the State Controller's Office. This guide provides you with step-by-step instructions to ensure your form is completed accurately and efficiently.

Follow the steps to successfully complete your CA STD 699 form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Proceed to Section A where you will indicate the type of enrollment action. Select one of the options: 'New', 'Change', or 'Cancel', and fill in your social security number.

- Complete your name in the space provided (First, Middle, Last) under Section A.

- If you selected 'New' or 'Change' in Section A, move to Section B. Here, indicate the type of account you wish to enroll for. Mark either 'C' for Checking or 'S' for Savings. It is mandatory to check one box; otherwise, the form will default to Checking.

- Enter the routing number associated with your financial institution. Ensure it does not start with a ‘5’ and does not exceed 9 digits.

- Next, input your depositor account number, making sure it does not exceed 17 digits.

- Fill in the name and address of your financial institution in the relevant fields provided in Section B.

- If you indicated 'New' or 'Change' in Section A, read Section C carefully and authorize the State Controller’s Office to deposit your salary in the designated account by providing your signature and the date.

- If you opted to cancel your enrollment in Section A, complete Section D by signing and dating the form to confirm your cancellation.

- Finally, if Section E is applicable, ensure that the personnel or payroll office of your state agency completes that section. After everything is filled out, submit your completed form to your personnel/payroll office.

- Once submitted, you can save changes, download, print, or share your completed form as needed.

Complete your CA STD 699 form online today and take the next step in enrolling for direct deposit.

Can an employer require direct deposit in California? Under California Labor Code section 213, employers cannot require an employee to receive payment of wages by direct deposit. A California employer can pay an employee by direct deposit only if the employee expressly consents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.