Loading

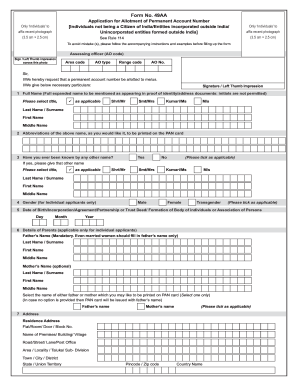

Get Form No. 10f Information To Be Provided Under Sub-section ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM NO. 10F Information To Be Provided Under Sub-section ... online

This guide provides a comprehensive overview of how to accurately fill out the FORM NO. 10F Information To Be Provided Under Sub-section ... online. It aims to assist users by offering clear instructions tailored to their needs.

Follow the steps to accurately complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the personal information accurately, including full name, abbreviation, and any previous names. Select the appropriate title and ensure no initials are used.

- Indicate your gender by selecting the applicable option. This field is mandatory for individual applicants.

- Provide your Date of Birth or the incorporation date as applicable, ensuring it is a valid date and correctly formatted.

- List your parent’s names if you're an individual applicant. Indicate which parent’s name should appear on the PAN card.

- Enter your complete residential address, including flat number, locality, town, state, and zip code. Ensure it reflects accurate information for communication.

- Specify your telephone number and email ID. Ensure to add the country code and check that the email ID is valid for correspondence.

- Select your status from the given options, indicating if you are applying as an individual, company, trust, etc.

- Mention your source of income and include relevant codes if you select income from business.

- Attach any required documents as proof of identity and address, ensuring they follow the guidelines provided.

- Sign the application form, ensuring that your signature aligns with the requirements for acceptance.

- Upon completion, save your changes, download the form for your records, and follow any necessary procedures for submission.

Complete your FORM NO. 10F application online today to ensure your data is accurately submitted.

Subsection 5 of Section 90 or 90A refers to a clause that only having a certificate proving you are a resident of a foreign country or a territory is essential but not enough to claim tax relief. This makes non-residents of India eligible to claim a tax credit under the DTAA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.