Loading

Get Irs 8872 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8872 online

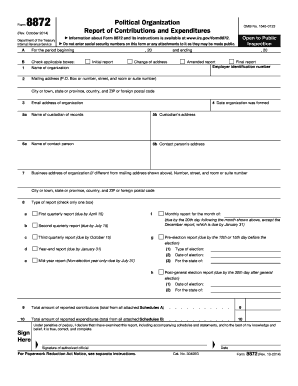

Filling out the IRS 8872 form, also known as the Political Organization Report of Contributions and Expenditures, is an important step for organizations seeking compliance with federal reporting requirements. This guide will provide clear instructions to assist users in completing the form online efficiently.

Follow the steps to fill out the IRS 8872 accurately.

- Click ‘Get Form’ button to access the form in the appropriate editor.

- In section A, enter the period beginning and ending dates of the reporting period.

- Check the applicable boxes to indicate whether this is an initial, amended, or final report.

- Fill in the organization's name, mailing address, and employer identification number.

- Provide the date the organization was formed and the email address of the organization.

- Enter the name and address of the custodian of records and the name and address of a contact person for the organization.

- If applicable, enter the business address of the organization.

- Select the type of report from the options available, ensuring only one box is checked.

- Report the total amount of contributions from all attached Schedules A.

- Report the total amount of expenditures from all attached Schedules B.

- Sign and date the form under penalties of perjury. Ensure all information is accurate.

- Once complete, save changes, download, print, or share the completed form as necessary.

Complete your IRS 8872 form online today to ensure compliance with reporting requirements.

Internal Revenue Service or IRS is a United States Government agency which is responsible for collection of taxes and enforcement of tax laws like the wash sale rule. The primary purpose of this service is to collect individual and employment taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.