Loading

Get Form S-1 Instructions For Filing Succession Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form S-1 Instructions For Filing Succession Tax Return online

Filling out the Form S-1 Instructions for Filing Succession Tax Return online can seem daunting, but this guide provides you with clear and concise steps to make the process easier. By following these instructions, you will be well-equipped to complete the form with confidence.

Follow the steps to accurately complete the Form S-1

- Click ‘Get Form’ button to obtain the form and open it in the available editor.

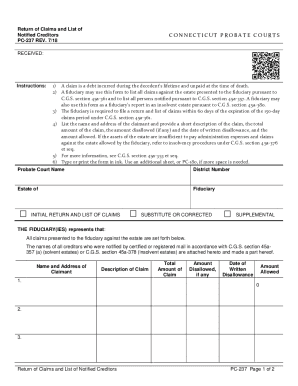

- Begin filling out the form by entering the name of the probate court and the district number at the top. Ensure that you input accurate information as this will be critical for the processing of the return.

- List the estate of the decedent, including the name and relevant details of the fiduciary. This information helps identify the responsible party managing the estate.

- Fill in the sections regarding claims against the estate. For each claim, provide the claimant's name and address, a brief description of the claim, the total amount requested, the amount disallowed (if any), the date of any written disallowance, and the amount that is allowed.

- If there are more claims than fit on the initial page, use an additional sheet or form PC-180 as necessary. Ensure that all claims are documented comprehensively.

- At the bottom of the form, calculate the total amount allowed and enter this figure in the designated space.

- Finally, the fiduciary must sign and date the form. Print or type their name as required before submission.

- Once the form is complete, review all entries for accuracy. Save any changes made, and prepare to download, print, or share the form as needed.

Complete your documents online today and ensure you meet all necessary requirements efficiently.

Capital property (such as real estate, investments, or personal belongings) owned by the person who died is considered to be disposed of by that person immediately before their death at fair market value, and may result in a capital gain or a capital loss which must be reported on Schedule 3 of the Final Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.