Loading

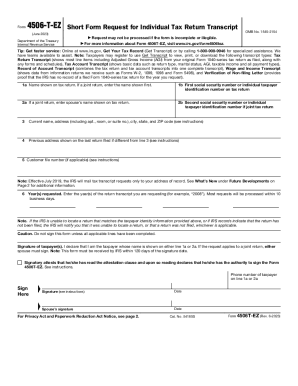

Get Form 4506-t-ez (rev. 6-2023). Short Form Request For Individual Tax Return Transcript

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 4506-T-EZ (Rev. 6-2023). Short Form Request For Individual Tax Return Transcript online

Filling out Form 4506-T-EZ allows individuals to request their tax return transcripts quickly and efficiently. This guide will help you navigate each section of the form to ensure a successful and accurate submission.

Follow the steps to complete Form 4506-T-EZ for your tax return transcript request.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In line 1a, enter the name shown on your tax return. If you filed a joint return, list the name that appears first.

- In line 1b, input your first social security number or individual taxpayer identification number as shown on the tax return.

- If applicable, fill in line 2a with your spouse’s name as shown on the tax return. On line 2b, provide the second social security number or taxpayer identification number.

- Enter your current address in line 3, including any apartment, room, or suite number, along with city, state, and ZIP code.

- If your previous address differs from what you entered in line 3, include it in line 4.

- Line 5 is optional; if desired, provide a customer file number that will appear on your transcript. This should not include an SSN.

- Indicate the year(s) for which you are requesting transcripts in line 6. For most requests, processing typically takes about 10 business days.

- Do not sign the form until all applicable lines are completed. In the signature section, the taxpayer must sign and date the form.

- Submit your completed form by mailing or faxing it to the appropriate IRS address based on your filing state.

- Upon completion of the form, you can save changes, download, print, or share it as needed.

Begin the process of obtaining your tax return transcript online today!

▶ For more information about Form 4506-T, visit .irs.gov/form4506t. Tip: Get faster service: Online at .irs.gov, Get Your Tax Record (Get Transcript) or by calling 1-800-908-9946 for specialized assistance. We have teams available to assist.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.