Loading

Get Nj E-form Ntp-1 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ E-Form NTP-1 online

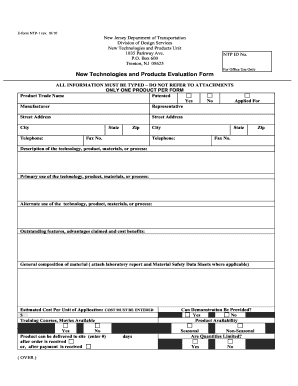

The NJ E-Form NTP-1 is a crucial document for the evaluation of new technologies and products intended for use by the New Jersey Department of Transportation. This guide provides a comprehensive, step-by-step method for filling out the form online, ensuring that all necessary information is accurately submitted.

Follow the steps to complete the NJ E-Form NTP-1 online.

- Click ‘Get Form’ button to obtain the form and open it for online completion.

- Begin by inputting the NTP ID number, if applicable, along with the product trade name. Note that only one product is permitted per form.

- Fill in the manufacturer representative's details, including their street address, city, state, zip code, telephone number, and fax number.

- Provide a comprehensive description of the technology, product, materials, or process being evaluated. Make sure to clearly outline its primary and alternate uses.

- Detail the general composition of the material, ensuring to attach any necessary laboratory reports and Material Safety Data Sheets.

- Enter the estimated cost per unit of application in the designated field.

- Indicate whether training courses or promotional materials are available related to the product.

- Answer questions regarding any specifications the product meets, any organization that has tested it, and its manufacturing origin.

- Include information about the product's market introduction date and what existing processes or products it is intended to replace.

- Complete the section on recommendations and previous contacts with the New Jersey Department of Transportation.

- Confirm if your organization can provide the necessary material for two demonstration projects and complete the signature section by typing or printing the name of the person providing the information, along with their title, signature, and date.

- After filling out the form, ensure to save any changes made. You may download, print, or share the completed form as needed.

Start completing your NJ E-Form NTP-1 online today to ensure a smooth submission process.

Nonresidents who earn income from New Jersey sources must file a nonresident return. This includes people who work or have business activities within the state. By using the NJ E-Form NTP-1, nonresidents can easily complete their forms online, ensuring secure and efficient processing of their tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.