Loading

Get Worksheet For Determining Support 2018-2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Worksheet For Determining Support 2018-2019 online

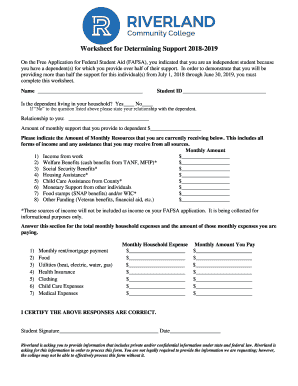

The Worksheet For Determining Support 2018-2019 is essential for independent students who provide substantial support to dependents. Completing this form accurately demonstrates your financial commitment and ensures proper assessment of your situation.

Follow the steps to complete the worksheet effectively.

- Press the ‘Get Form’ button to access the worksheet and load it in the online editor.

- Begin by entering your name and Student ID at the top of the form.

- Indicate if the dependent lives in your household by selecting 'Yes' or 'No.' If 'No,' specify the relationship to the dependent.

- State the amount of monthly support you provide to the dependent in the designated field.

- List all sources of monthly income you are currently receiving, filling in the amounts for income from work, welfare benefits, Social Security benefits, housing assistance, child care assistance, monetary support from others, food stamps, and any other funding.

- Provide information about your total monthly household expenses, including rent/mortgage, food, utilities, health insurance, clothing, child care expenses, and medical expenses.

- Record the amount you pay for each of the listed monthly expenses.

- Review all the entered information for accuracy to ensure the responses are correct.

- Sign and date the form to certify that the information provided is accurate.

- Once completed, you can save your changes, download the document, print it, or share it as needed.

Complete your Worksheet For Determining Support online today for an efficient application process.

The IRS defines a dependent as a qualifying child (under age 19 or under 24 if a full-time student, or any age if permanently and totally disabled) or a qualifying relative. A qualifying dependent can have income but cannot provide more than half of their own annual support.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.