Get Request To Lower An Income-related Monthly Adjustment ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Request To Lower An Income-Related Monthly Adjustment online

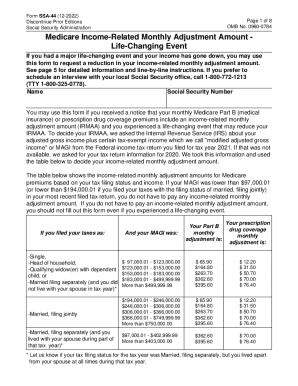

Filling out the Request To Lower An Income-Related Monthly Adjustment form can seem daunting, but this guide will provide clear and supportive instructions to help you navigate the process online. This form is essential for individuals affected by life-changing events that may reduce their Medicare income-related monthly adjustment amount.

Follow the steps to complete the form successfully.

- Press the 'Get Form' button to access the form and open it in your preferred document editor.

- Enter your full name and Social Security Number exactly as they appear on your Social Security card.

- Select one life-changing event from the list provided and input the date that the event occurred (in mm/dd/yyyy format). The options are marriage, work reduction, divorce/annulment, loss of income-producing property, death of your spouse, loss of pension income, work stoppage, or employer settlement payment.

- Indicate the tax year in which your income was affected by the life-changing event. Fill in your adjusted gross income (AGI) and tax-exempt interest income, along with your tax filing status for that year.

- Answer whether your modified adjusted gross income will be lower next year than the one indicated in Step 2. If yes, complete the fields for the next year's tax year, estimated AGI, estimated tax-exempt interest, and expected tax filing status.

- Provide documentation that supports your request. You can attach the required evidence or show it to an SSA employee.

- Read the information carefully before signing the form. After signing, include your phone number and mailing address to ensure they can contact you if needed.

- Once all fields are completed, save changes, download the form for your records, print it, or share it as necessary.

Take the next step and complete your request online for a potential reduction in your income-related monthly adjustment.

Get form

Rule 15.01 of the Tennessee Rules of Civil Procedure provides a party may amend its pleading “once as a matter of course at any time before a responsive pleading is served[.]” A motion to dismiss is not a responsive pleading and under Rule 15.01 the plaintiff has an absolute right to file an amended complaint. Grose v.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.