Loading

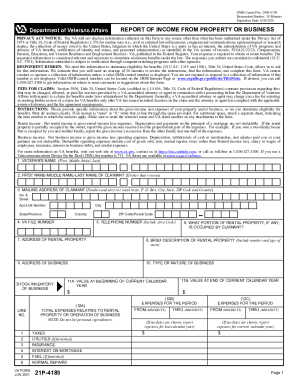

Get Va Form 21p-4185. Report Of Income From Property Or Business

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form 21P-4185. REPORT OF INCOME FROM PROPERTY OR BUSINESS online

This guide provides step-by-step instructions on how to complete the VA Form 21P-4185, which is essential for reporting income from property or business. By following these directions, users can effectively navigate the online form to ensure accurate reporting.

Follow the steps to complete your form efficiently.

- Press the ‘Get Form’ button to retrieve the form and open it in your preferred document editor.

- Begin by entering the veteran's name in the first field. Ensure that you provide the first name, middle initial, and last name accurately.

- If the claimant is different from the veteran, fill out the next field with the first name, middle name, and last name of the claimant.

- Provide the mailing address of the claimant, including street number, apartment or unit number, city, state, ZIP code, and country.

- Fill in the VA file number associated with the claimant, which helps identify the record.

- Indicate the claimant's telephone number, including the area code, to facilitate communication.

- Specify what portion of the rental property is occupied by the claimant, if applicable.

- Enter the address of the rental property being reported.

- Provide a brief description of the rental property, including the number and type of units.

- Enter the address of the business, if applicable.

- Describe the type or nature of the business in the provided field.

- Complete the stock inventory section, entering the value at the beginning and end of the current calendar year.

- List all expenses related to the rental property or business operation, ensuring to exclude personal expenditures. Include taxes, utilities, insurance, interest on mortgage, fuel, normal repairs, and cost of goods sold.

- Report total gross income, total expenses, and net income from the rental property or business in the respective lines.

- If the property or business is jointly owned, include your share of net income and the fractional share of ownership.

- In the Remarks section, provide any additional details regarding income or expenses as needed, including net property or business income for joint owners, if applicable.

- Sign the form in the designated area to certify that the information is true and correct to the best of your knowledge.

- Enter the date, and provide daytime and evening telephone numbers for further contact if necessary.

- If signing by mark, ensure to include signatures of two witnesses who know the claimant personally, along with their printed names and addresses.

- Review the completed form for accuracy, then save changes, download, print, or share the document as needed.

Complete your VA Form 21P-4185 online today for efficient processing of your benefits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you give up your rights do you have to pay Tennessee child support? Parents who surrender parental rights as part of an adoption, say to a step-parent, are no longer required to pay future child support. The same applies if parental rights are terminated by law, as in some cases of child abandonment and non-support.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.