Loading

Get Tx Silver Oaks Hoa Arb Form 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Silver Oaks HOA ARB Form online

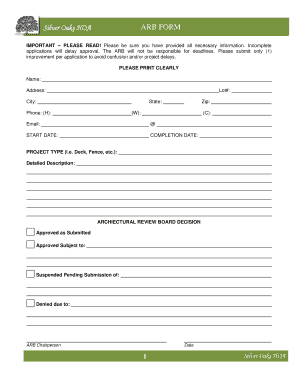

Filling out the TX Silver Oaks HOA ARB Form online can be a straightforward process when you understand each section and field. This guide provides step-by-step instructions to assist you in successfully submitting your application for approval.

Follow the steps to complete the ARB form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your personal details. Fill in your name, address, lot number, city, state, phone numbers, and email address clearly. Ensure all information is accurate to avoid any processing delays.

- Specify the start and completion dates for your project. This information is important for the review process.

- Select the project type by entering a brief description, such as 'deck' or 'fence'. Provide a detailed description of the intended improvement, including placement and construction details.

- Prepare and include the application requirements. Make sure to gather and attach a detailed written description, plat/survey of your property, design sketches or photos, description of materials, architectural plans (if needed), and a grading plan if applicable.

- Obtain acknowledgments from two adjacent property owners who might be affected by your proposed change. This requires their signatures, which indicate they are aware of your project.

- Acknowledge your responsibilities as the applicant, ensuring to read and comply with all applicable guidelines and ordinances, before signing the form.

- Once all sections are complete, review the form to confirm accuracy. You can then save changes, download, print, or share the completed form as necessary.

Compete your form online today to ensure a timely review of your application.

Related links form

Per Tennessee Code § 67-4-409, the state imposes a Realty Transfer Tax on most transfers of real property. For quitclaim deeds, the amount of the tax is at a rate of $0.37 per $100 of the property's purchase price.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.