Loading

Get Usalliance Financial Add Joint Owner Form 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the USALLIANCE Financial Add Joint Owner Form online

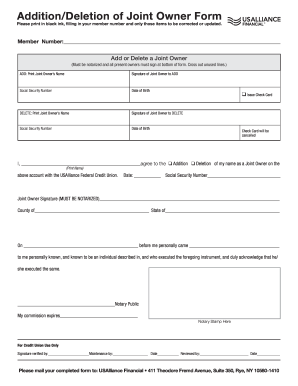

Completing the USALLIANCE Financial Add Joint Owner Form is an essential step for adding or removing a joint owner from your financial account. This guide will provide clear, step-by-step instructions to help you successfully fill out the form online.

Follow the steps to fill out the form correctly

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your member number in the designated field. Ensure that this information is accurate to avoid delays in processing.

- Decide if you are adding or deleting a joint owner. Indicate your choice by marking the appropriate option on the form.

- If adding a joint owner, print the name of the individual you wish to add, followed by their signature, social security number, and date of birth in the specified fields.

- If deleting a joint owner, print the name of the individual you wish to remove in the relevant section. Also include their signature, social security number, and date of birth.

- Decide if a check card is to be issued to the new joint owner. Indicate your preferences by checking the corresponding option.

- For added validation, you must agree to the addition or deletion of your status as a joint owner. Print your name, the date, social security number, and provide your signature in the corresponding fields.

- Remember that the joint owner’s signature must be notarized for the form to be valid. Ensure this is done before submitting the form.

- Once the form is completely filled out, review it for completeness and accuracy. Save your changes if using online tools, or print it for mailing.

- Mail your completed form to: USAlliance Financial • 411 Theodore Fremd Avenue, Suite 350, Rye, NY 10580-1410.

Complete your form online today for a smooth addition or deletion process.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.