Loading

Get Wy Form 42-1 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WY Form 42-1 online

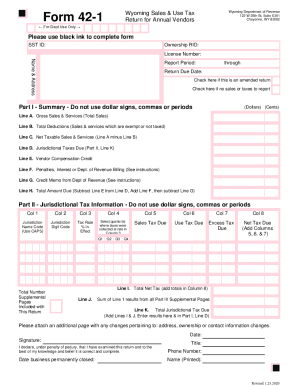

Completing the WY Form 42-1 online is a straightforward process that ensures your sales and use tax return is accurately submitted. This guide will provide you with step-by-step instructions to help you navigate each section of the form efficiently.

Follow the steps to complete your WY Form 42-1 online.

- Press the ‘Get Form’ button to access the WY Form 42-1 and open it in the editor.

- Begin by filling out the top section of the form. Enter your SST ID, Ownership RID, and License Number accurately to ensure proper identification.

- Provide your Name & Address in the specified fields to ensure correspondence is directed to the correct location.

- Specify the Report Period by entering the start and end dates in the designated spaces.

- Indicate the Return Due Date. If applicable, check the box if you are submitting an amended return or if there are no sales or taxes to report.

- In Part I - Summary, enter your gross sales and services (Line A) without using dollar signs, commas, or periods. Follow this by listing total deductions (Line B).

- Calculate your net taxable sales and services by subtracting Line B from Line A (Line C). Fill in the appropriate values for jurisdictional taxes due (Line D), vendor compensation credit (Line E), and any penalties or billing information (Line F). Lastly, calculate the total amount due (Line H).

- Proceed to Part II - Jurisdictional Tax Information. For each jurisdiction, fill in the required columns including the name code, digit code, tax rate, and select the applicable quarters. Accurately calculate and enter the sales tax due, use tax due, excess tax due, and net tax due.

- At the end of Part II, complete Line I by totaling your net tax from Column 8. Add any results from supplemental pages on Line J and calculate the total jurisdictional tax due (Line K). Make sure to refer back to Part I, Line D for final entries.

- Complete the footer of the form by providing the date, your signature, and title. Fill in your printed name and phone number. Lastly, if applicable, provide the date the business was permanently closed.

- Review all the entered information for accuracy. Once confirmed, you can save your changes, download a copy, print it, or share the form as needed.

Complete your WY Form 42-1 online now to ensure timely submission of your sales and use tax return.

State wide sales tax is 4%. In addition, Local and optional taxes can be assessed if approved by a vote of the citizens. See the publications section for more information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.