Loading

Get 4a 214 Community Property And Debt Schedule Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 4a 214 Community Property And Debt Schedule Form online

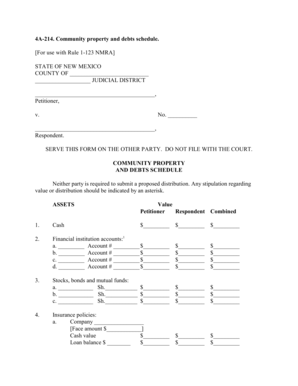

Completing the 4a 214 Community Property And Debt Schedule Form is essential for accurately presenting the division of assets and debts during legal proceedings. This guide will walk you through the process, ensuring you fill out each section correctly and efficiently online.

Follow the steps to accurately complete the form online.

- Press the 'Get Form' button to access the document and open it in your preferred digital editor.

- Begin by identifying and entering the names of the petitioner and respondent at the top of the form. Ensure the case number and judicial district are correctly filled out.

- In the community property section, categorize the assets and debts. Start with cash. Enter the values under the petitioner and respondent columns, as well as the combined total.

- Move on to financial institution accounts. Provide details for each account, including the type, account number, and respective values.

- List any stocks, bonds, or mutual funds, specifying the quantity and values associated with each.

- Provide information on insurance policies, detailing the company, face amount, cash value, and loan balance for both parties.

- Input real estate details, including the title of the property, mortgage payments, cost of sale, and any other relevant financial obligations.

- Document vehicle information by stating the type of vehicle, its lien details, and associated values.

- List any business assets, household goods, tax refunds, and retirement accounts in the designated sections.

- Once all sections are complete, calculate the total assets and total debts. This includes verifying the estimated net assets and equalization of assets.

- Finally, read through the affirmation statement, provide your signature, and fill in your printed name, mailing address, and contact number.

- After reviewing all entries for accuracy, save your changes, download a copy, or share the completed form as necessary.

Start completing your documents online today for a more efficient process.

The main benefit of putting a house in a trust in Texas is to bypass the probate process. Even if you have a will, all of your assets will go through probate when you die. For married couples, placing a house in trust ensures that the surviving spouse becomes the sole owner when the other spouse dies.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.