Loading

Get Mt Big Sky Economic Development Sba 504 Loan Application 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT Big Sky Economic Development SBA 504 Loan Application online

Filling out the MT Big Sky Economic Development SBA 504 Loan Application online can seem daunting, but this guide is designed to walk you through each section with clarity and structure. By following these steps, you can ensure that your application is completed accurately and efficiently.

Follow the steps to successfully complete your loan application.

- Press the ‘Get Form’ button to access the SBA 504 Loan Application. This will allow you to retrieve the form and start the completion process.

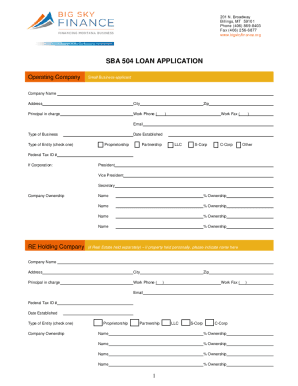

- Begin by filling out the 'Operating Company' section. Include your company name, address, city, and zip code. Provide the principal in charge's work phone, fax, and email, as well as the date your company was established.

- Indicate your type of business and entity by checking the appropriate options, such as proprietorship, partnership, LLC, S-Corp, or C-Corp. Make sure to also include your Federal Tax ID number.

- In the 'Company Ownership' section, list each owner's name along with their percentage of ownership. If applicable, include details about any real estate held separately.

- Complete the 'New Project Information' section by providing the project address and state, as well as the square footage your company will occupy, and other relevant project details such as realtor’s name and escrow closing date.

- Fill in the financial components related to your project, such as the purchase price, land acquisition costs, remodel expenses, and totals for funding needs.

- In the 'Employees' section, provide details on both part-time and full-time employees, including current and estimated future counts as a result of the project.

- List any affiliate businesses owned by principals with 20% or more ownership in your operating company, including their ownership details.

- Answer the miscellaneous questions regarding bankruptcy, lawsuits, and previous SBA loans. Provide details when necessary on a separate sheet.

- Include all required documentation in the checklist section, ensuring you have valid financial statements, tax returns, a business plan, and other specific documents that are pertinent to your application.

- Complete the 'Authorization to Release Information' section by signing and dating where indicated. Make sure both applicants provide their signatures.

- Lastly, review all entries for completeness and accuracy. Save your changes, and consider options to download, print, or share the application as necessary.

Start completing your application online today for a chance to secure your SBA 504 loan.

While there's no official required SBA loan credit score from the Small Business Administration, lenders will often set minimum personal and business credit score requirements for SBA loan applicants. An SBSS of 140 to 160+ or a personal score of 620 to 640+ are commonly needed to qualify.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.