Loading

Get Ct P-247 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT P-247 online

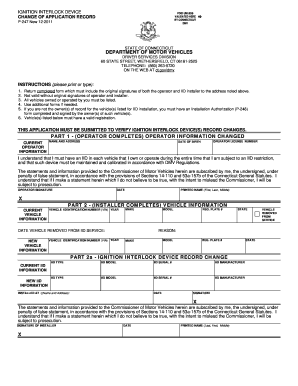

The CT P-247 form is used for reporting changes related to ignition interlock devices in Connecticut. This guide will provide you with a clear, step-by-step process to complete the form online with confidence.

Follow the steps to successfully complete the CT P-247 form online.

- Press the ‘Get Form’ button to access the CT P-247 form and open it in your online document editor.

- Carefully read the instructions provided at the top of the form. Ensure that you understand the requirements, including the need for original signatures and that all vehicles owned or operated must be listed.

- In Part 1, fill out the operator information section by providing your current name, address, operator license number, and date of birth. Make sure all information is accurate.

- Acknowledge the statement regarding the ignition interlock device by signing and dating the form. Ensure your printed name is included in the designated area.

- Proceed to Part 2 and fill in the current vehicle information, including the vehicle identification number (VIN), year, make, and the date the vehicle was removed from IID service.

- Complete the new vehicle information section if applicable by entering the new vehicle's details, including VIN, year, model, registration plate number, and state.

- In Part 2a, provide information regarding the ignition interlock device changes. Fill in the type, model, serial number, and manufacturer for both current and new IIDs.

- Indicate the name and address of where the new IID is installed. Include the date of installation.

- Both the operator and the installer must provide their signatures and dates in the appropriate sections to validate the form.

- Once all sections are complete and reviewed for accuracy, save your changes. You can then download, print, or share the completed form as needed.

Complete your CT P-247 online today for a seamless documentation experience.

When filling out your tax withholding form, start by providing your personal information accurately. Then, calculate the number of allowances you wish to claim based on your financial situation. To ensure you're maximizing your tax benefits, CT P-247 offers excellent tools and guidance to assist you in completing this form correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.