Loading

Get Declaration Pursuant To California Probate Code §13101

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Declaration Pursuant To California Probate Code §13101 online

Filling out the Declaration Pursuant To California Probate Code §13101 online can seem daunting, but with this guide, you can navigate each section easily and accurately. This form is essential for individuals who need to declare a claim to a decedent's property after a specified period.

Follow the steps to complete the form successfully.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

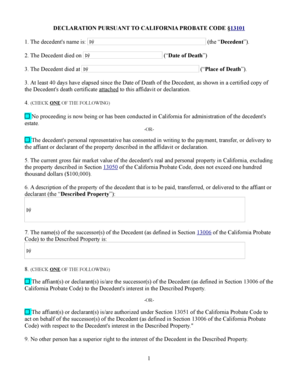

- Begin by entering the decedent's name in the first field provided. This is the person who has passed away.

- In the next field, record the date of death as specified in the decedent's death certificate.

- Fill in the place of death, providing the location where the decedent passed away.

- Confirm that at least 40 days have passed since the decedent's date of death by ensuring that you attach a certified copy of their death certificate.

- Select one of the two options regarding any ongoing proceedings for the administration of the decedent's estate. If there are no proceedings, check the first option. If there is a personal representative who consented to the property transfer, check the second option.

- Indicate the current gross fair market value of the decedent's property in California, ensuring it does not exceed $100,000.

- Describe the property that is to be transferred to you or the person making the declaration. This description should be clear and detailed.

- List the names of the successors to the described property as defined under California Probate Code.

- Choose one of the following statements regarding your status as a successor or your authority to act on behalf of the successor.

- Affirm that no other person has a superior right to the decedent's interest in the described property.

- Request that the described property be paid, delivered, or transferred to yourself or the declarant.

- Finally, affirm that all provided information is true and correct, noting the date and signing your name. If applicable, include additional signers as needed.

- Save your changes, download the completed form, and prepare to print or share it as required.

Complete your documents online today for a seamless filing experience.

This form is used to allow the Executor(s)/Next of Kin to legally transfer shares from a person who has passed away into their name(s) and provides information in regards to how the shares can be sold.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.