Loading

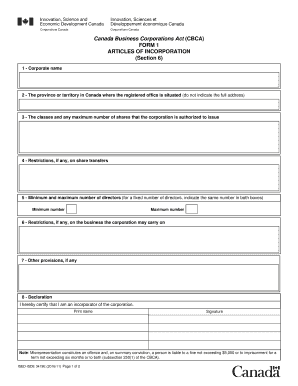

Get Ised-isde 3419e - Articles Of Incorporation. Form 1 - Articles Of Incorporation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ISED-ISDE 3419E - Articles Of Incorporation. Form 1 - Articles Of Incorporation online

Filing the ISED-ISDE 3419E - Articles Of Incorporation online is an essential step in establishing your corporation in Canada. This guide will provide you with clear and detailed instructions on how to complete each section of the form, ensuring a smooth application process.

Follow the steps to effectively complete your Articles Of Incorporation online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the proposed corporate name in item 1. Ensure that the name complies with sections 10 and 12 of the Canada Business Corporations Act. Remember to include a Nuans Name Search Report dated within 90 days, if applicable.

- In item 2, provide the name of the province or territory in Canada where your registered office will be located. Only the name is needed, not the full address.

- For item 3, outline the classes and any maximum number of shares the corporation is authorized to issue. Include details on rights, privileges, restrictions, and conditions attached to each class of shares.

- If applicable, enter any restrictions on share transfers in item 4. Clearly state the nature of these restrictions.

- In item 5, specify the minimum and maximum number of directors for your corporation. Ensure to indicate the same number if you opt for a fixed number of directors.

- If your corporation will have any restrictions on the type of business carried out, enter these limitations in item 6.

- For item 7, include any additional provisions that are permitted under the CBCA and that you want in your articles, such as pre-emptive rights or cumulative voting provisions.

- Finally, complete item 8 by certifying your role as an incorporator. Print your name and provide your signature. If an incorporator is a corporation, include the authorized individual’s name and signature.

- If space is lacking in items 3, 4, 6, 7, or 8, attach a separate schedule. Review all entries for accuracy before submission.

- After completing the form, save your changes. You can then download, print, or share the form as necessary.

Start completing your Articles Of Incorporation online today for a streamlined application process.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.