Loading

Get Ca Llc-1a 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA LLC-1A online

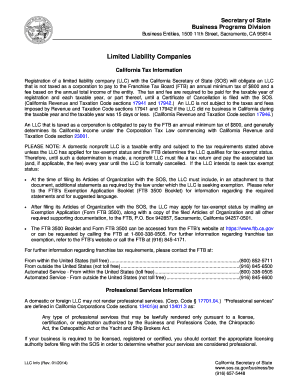

Filing the California LLC-1A form is a crucial step for converting your business into a limited liability company. This guide provides a straightforward approach to help you complete the online submission with ease.

Follow the steps to successfully fill out the CA LLC-1A online.

- Press the ‘Get Form’ button to access the CA LLC-1A document and open it in the editor.

- Enter the name of the limited liability company exactly as it should appear on state records. Remember, the name must include 'Limited Liability Company', 'LLC', or 'L.L.C'.

- Indicate the purpose of the limited liability company, which should state it will engage in any lawful activity permitted under California law.

- Select the management structure by checking the appropriate box: 'One Manager', 'More Than One Manager', or 'All Members'.

- Provide the initial street address for the designated office in California. Ensure no P.O. Box addresses are used.

- If different, input the mailing address, but skip this step if it matches the street address provided in Step 5.

- Name the agent for service of process. This can be an individual or a registered corporate agent. Ensure they consent to this role.

- If the agent is an individual, provide their business or residential street address. Avoid using a P.O. Box or 'in care of' addresses.

- Specify the name of the converting entity as it appears in official records.

- Identify the form of the converting entity (such as corporation or limited partnership).

- Indicate the jurisdiction where the converting entity was formed.

- Enter the California Secretary of State file number if one has been issued to the converting entity.

- If a vote was necessary for the conversion, outline the necessary details related to the required votes.

- Attach any additional information that must be included in the Articles of Organization of the converted entity.

- Ensure the form is signed according to the required statutes, and include additional signatures as necessary.

- Upon completion, save changes, download, print, or share the filled form as needed.

Complete your CA LLC-1A online today and ensure your business is properly registered.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The costs that you pay after your LLC is formed are also tax-deductible. You can deduct California's $800 annual tax, along with any annual fee you pay, from your federal taxes. You can also deduct maintenance costs for your LLC, including business license fees and registered agent fees.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.