Loading

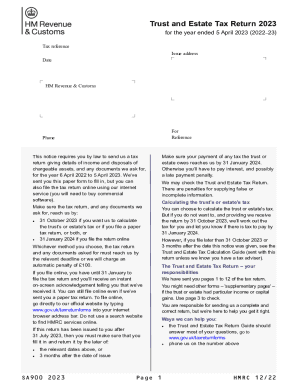

Get Sa900man. Use Form Sa900(2023) To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SA900man: Use Form SA900(2023) to file a tax return for a trust or estate for the tax year ended 5 online

Filing a tax return for a trust or estate can seem daunting, but with the right guide, the process can be manageable. This comprehensive guide will provide you with step-by-step instructions on how to complete the SA900 form for the tax year ended 5 April 2023 while utilizing online options.

Follow the steps to successfully complete the SA900 tax return for your trust or estate.

- Press the ‘Get Form’ button to obtain the SA900 form and open it in your preferred document editor.

- Review the instructions provided on the form. Ensure that you have all necessary information related to the trust or estate, including income details and any relevant calculations.

- Begin filling out the form by entering the tax reference number, issue address, and other identifying information at the top of the document.

- Proceed to the income and capital gains sections. Answer questions regarding income sources, profits or losses from trades, property income, and any foreign income or gains. Follow the guidance within the Trust and Estate Tax Return Guide for assistance.

- Check if you need supplementary pages based on your previous answers. Download any necessary supplementary pages from the official resources if applicable.

- Complete the relevant sections on annual payments, claims for relief, and special tax treatments as applicable to your situation.

- If required, provide additional information regarding asset contributions to the trust during the tax year.

- Ensure you complete all signature and declaration sections at the end of the form, including your name and the date.

- Finally, review the completed document for accuracy before saving your changes. You may then download, print, or share the form as needed.

Start filing your SA900 tax return online today to ensure compliance and avoid penalties.

If a person maintains insurance and a valid license and pays the fee within 180 days, they can have their charges dismissed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.