Loading

Get In State Form 44954 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN State Form 44954 online

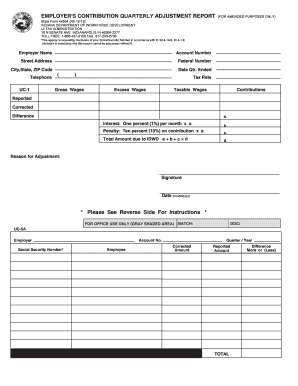

This guide provides clear, step-by-step instructions on how to complete the IN State Form 44954, an employer's contribution quarterly adjustment report, online. Whether you are familiar with such forms or not, this comprehensive guide is designed to support you through each section.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your employer name in the designated field. Ensure that the name matches the official registry.

- Input your account number, which you can find in your tax documents. This helps validate your submission.

- Fill in your street address, including any necessary details to make it complete.

- Enter your federal number. This number is crucial for federal tax identification.

- Provide the city, state, and ZIP code where your business is located.

- Include your telephone number to facilitate communication regarding your submission.

- Indicate the quarter ended date in the appropriate field. Use the mm/dd/yyyy format for consistency.

- Enter your tax rate as required based on your payroll and tax obligations.

- Input gross wages reported for the specified quarter.

- Enter excess wages if applicable. This section helps in detailing your tax adjustments.

- Fill out the taxable wages calculated for the quarter.

- Detail the contributions reported and corrected in the respective fields.

- Compute the difference between reported and corrected contributions.

- Calculate interest at one percent (1%) per month based on the reported contributions.

- Include any penalties applicable, calculated at ten percent (10%) of the contribution amounts.

- Sum the totals of the amounts due and ensure accuracy in your calculations.

- Indicate the reason for your adjustments in the provided space.

- Sign and date the form in the designated signature area. Ensure the date is in mm/dd/yyyy format.

- Review all entries for accuracy before finalizing your submission.

- Save your changes, download a copy for your records, print the form, or share it as needed.

Start completing your IN State Form 44954 online today to ensure your filings are accurate and submitted promptly.

Your landlord has to do anything your tenancy agreement says they have to do. Your landlord is also generally responsible for keeping in repair: the structure and exterior of your home, for example, the walls, roof, foundations, drains, guttering and external pipes, windows and external doors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.