Loading

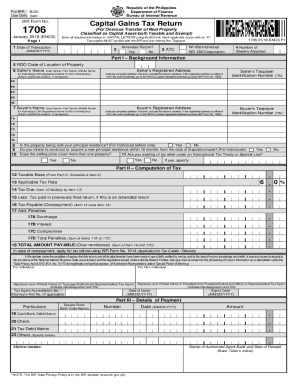

Get Ph Bir Form 1706 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR Form 1706 online

Filing your PH BIR Form 1706 online can streamline the reporting of capital gains tax related to the transfer of real property. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Fill in the date of the transaction in the required MM/DD/YYYY format. Ensure you check the box indicating if this is an amended return.

- Select the appropriate ATC code for the transaction type. Indicate the number of sheets attached to your form.

- Provide background information in Part I, including the RDO code, seller's name, registered address, and taxpayer identification number (TIN). Make sure to attach additional sheets if needed.

- Enter the buyer's information similar to the seller's details, including their name, address, and TIN.

- Respond to the questions regarding the property status, such as if it is your principal residence and if you plan to construct a new residence within 18 months.

- In Part II, calculate the taxable base and applicable tax rate. Compute the tax due and deduct any previously paid taxes, if applicable.

- Complete Part III by detailing your payment method. Fill in particulars, including bank details and amounts.

- For Part IV, provide information on the description of the transaction and tax computation. Ensure to indicate any specifics for installments or exemptions.

- Review all sections for accuracy, then save your changes. You can download the completed form, print it, or share it as needed.

Start filling out your PH BIR Form 1706 online today for a seamless tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

A person is exempted from capital gains tax if the reason for selling their property is to buy or construct a new property. However, a person has no records of availing of the tax exemption for the last decade.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.