Loading

Get Ie Tr1 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE TR1 online

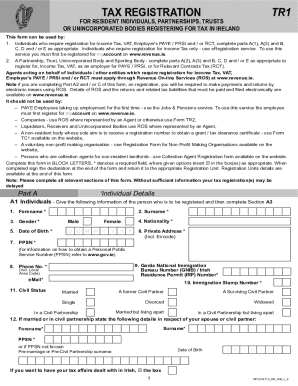

The IE TR1 form is essential for individuals, partnerships, trusts, and unincorporated bodies registering for tax in Ireland. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the IE TR1 form online:

- Press the ‘Get Form’ button to access the IE TR1 form and open it for editing.

- Part A: Individual details. Fill in the personal information required for the individual registering for tax, including forename, surname, date of birth, nationality, and PPSN.

- Complete additional information related to contact details, immigration status, and civil status. If applicable, include your spouse or civil partner’s details.

- Part A2: For partnerships, trusts, or unincorporated bodies, provide the organization’s name and responsible person's contact information.

- In Part A3, include relevant business details, such as the registration number, trading name, legal format, business address, expected turnover, and advisor details.

- Part B: Indicate your registration for Income Tax and specify your main source of income.

- Part C: If applying for VAT registration, check the appropriate boxes and complete the required information regarding expected turnover and business activities.

- Part D: For employer registration for PAYE/PRSI, fill in the number of employees and the payroll system that will be used.

- Part E: If registering for Relevant Contracts Tax (RCT), select the appropriate category (principal, subcontractor), and provide additional necessary information.

- Complete the declaration section at the end of the form, including your name, signature, capacity, and date.

- After reviewing your entries for accuracy, save changes, download the form, print it out, or share it as needed.

Complete your IE TR1 form online today for a smoother tax registration process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller. An owner can separate the mineral rights from land by: Conveying (selling or otherwise transferring) the land but retaining the mineral rights.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.