Loading

Get Mi W-4p 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI W-4P online

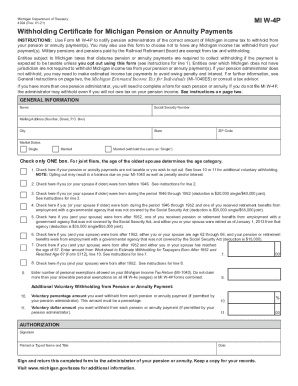

The MI W-4P is an essential form used by Michigan residents to inform pension administrators about the correct amount of income tax to withhold from pension or annuity payments. This guide offers a step-by-step approach to completing the form online, ensuring accurate and efficient filing.

Follow the steps to complete the MI W-4P form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your name in the designated field. Make sure to enter your full legal name as it appears on official documents.

- Enter your Social Security Number in the appropriate field. This information is used for tax identification purposes.

- Provide your mailing address by entering the number, street, and P.O. Box if applicable, followed by your city, state, and ZIP code.

- Select your marital status by checking only one box: Single, Married, or Married (withhold the same as 'Single').

- In line 1, check the box if your pension or annuity payments are not taxable or if you choose to opt out of withholding tax.

- Complete lines 2 through 8 as necessary, checking the relevant boxes about your age and tax benefits.

- Enter the number of personal exemptions allowed on your Michigan Income Tax Return in line 9. Ensure it does not exceed the allowable exemptions.

- If desired, specify a voluntary percentage in line 10 for additional withholding from each pension or annuity payment, ensuring this is permitted by your administrator.

- Optionally, enter a voluntary dollar amount for additional withholding from each pension or annuity payment in line 11, if allowed.

- Sign and date the form in the authorization section. Ensure that you include your printed or typed name and title.

- Once completed, submit the MI W-4P form to your pension or annuity administrator and keep a copy for your records.

Complete your MI W-4P form online today to ensure accurate withholding from your pension or annuity payments.

Upon your death, the property immediately transfers to the beneficiary designated in the deed. It's a streamlined way to pass down a home, but there is a catch: you can't sell or mortgage the property without the beneficiary's consent. A lady bird deed is considered an enhanced life estate deed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.