Get Az Wage Deduction Authorization For Federally Assisted Projects - City Of Phoenix 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Wage Deduction Authorization for Federally Assisted Projects - City of Phoenix online

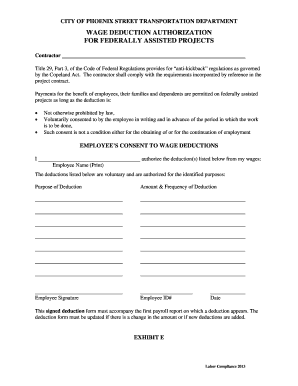

Filling out the AZ Wage Deduction Authorization is an essential step for employees working on federally assisted projects in the City of Phoenix. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete the form online:

- Click the ‘Get Form’ button to access the AZ Wage Deduction Authorization for Federally Assisted Projects and open it in your preferred editor.

- In the section titled 'Employee Name,' print your full name clearly to ensure proper identification.

- Next, provide the 'Purpose of Deduction' by stating what the deduction will be used for, such as insurance, retirement contributions, or any other specific purpose you wish to include.

- Indicate the 'Amount & Frequency of Deduction' clearly. Specify how much will be deducted from your wages and how often this deduction will occur (e.g., weekly, bi-weekly).

- Sign the form in the 'Employee Signature' field to authorize the deductions you listed. It is important that this is your signature to validate the document.

- Enter your 'Employee ID#' in the designated field to link the form to your employee record.

- Finally, include the 'Date' on which you are completing and signing the form to establish a record of when consent was given.

- Once you have filled out all the necessary sections, save your changes, and download the form. You can then print or share the completed document as needed.

Complete your AZ Wage Deduction Authorization online today for a smooth project experience.

Employers can deduct wages for mistakes, but it is vital that these deductions comply with existing laws and employee agreements. The AZ Wage Deduction Authorization For Federally Assisted Projects - City of Phoenix sets specific parameters that employers must follow to ensure fair treatment of employees. Transparency in this process cultivates trust and minimizes disputes. By leveraging tools like uslegalforms, businesses can manage wage deductions efficiently and legally.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.