Loading

Get Universal Property & Casualty Insurance Company Statement Of No Loss 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Universal Property & Casualty Insurance Company Statement Of No Loss online

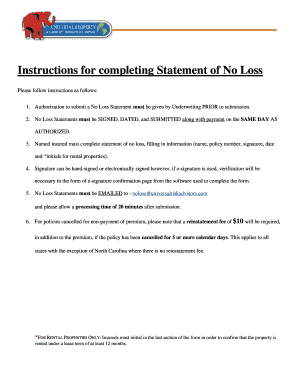

Completing the Universal Property & Casualty Insurance Company Statement Of No Loss is a straightforward process that ensures your insurance policy can be reinstated. This guide will walk you through the necessary steps to accurately fill out the form online.

Follow the steps to complete your Statement of No Loss efficiently.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Review the requirements to ensure you have authorization from Underwriting to submit a No Loss Statement before proceeding.

- Enter the named insured's full name in the designated field, ensuring it matches policy documentation.

- Fill in your policy number accurately in the provided space to link the statement to your insurance.

- Sign and date the form where indicated. You may use a hand signature or an electronic signature; if the latter is chosen, ensure you obtain and retain an e-signature confirmation page.

- If the property is a rental, ensure to initial the specified section to confirm its rental status under a lease for at least 12 months.

- After completing the form, prepare to email it to noloss@universalriskadvisors.com. Make sure to do this on the same day as authorized.

- If your policy has been canceled for non-payment of premium, include the $10 reinstatement fee if the cancellation was for 5 or more calendar days.

- Once the form is submitted, allow for a processing time of approximately 20 minutes.

- Keep a copy of your submission for your records and monitor for any confirmation regarding the processing of your No Loss Statement.

Complete your Statement of No Loss online today to ensure your coverage is reinstated.

Gift (i.e. immovable property received without consideration) received only on the occasion of marriage of the individual is not charged to tax. Apart from marriage there is no other occasion when gift received by an individual is not chargeable to tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.