Loading

Get Release Of Policy Information Authorization

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Release Of Policy Information Authorization online

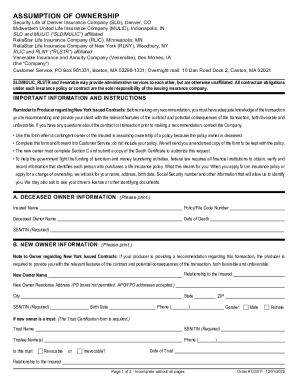

Filling out the Release Of Policy Information Authorization form is an essential step in ensuring a smooth transition of ownership for a life insurance policy when the original owner has passed away. This guide will provide you with clear instructions on how to accurately complete the form online.

Follow the steps to successfully complete your authorization form

- Click ‘Get Form’ button to obtain the form and open it in your document editor.

- In Section A, provide the deceased owner's information. Fill in the insured name, policy/file code number, the deceased owner's name, date of death, and their Social Security Number or Tax Identification Number.

- Move to Section B, where you will enter the new owner's information. Provide their relationship to the insured, full name, residence address (ensure no P.O. boxes), city, state, ZIP code, Social Security Number or Tax Identification Number, birth date, and phone number.

- If the new owner is a trust, specify the trust name, its Social Security Number or Tax Identification Number, names of the trustees, and whether the trust is revocable or irrevocable. Also include the trust date.

- Review the section regarding the assumption of ownership. Acknowledge that the ownership change meets policy terms and any existing beneficiary designations will remain unless specified otherwise.

- In Section C, verify your taxpayer certifications by confirming the accuracy of your Tax Identification Number, compliance with backup withholding regulations, and your U.S. residency status.

- Sign and date the form where indicated. If the new owner is a trust or similar entity, ensure the appropriate officer or partner signs. Include any necessary corporate resolutions if required.

- Once the form is completed, save any changes made, then download or print the final document for your records or to be sent to Customer Service.

Complete your Release Of Policy Information Authorization online today.

How to Transfer Texas Real Estate Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). ... Create a new deed. ... Sign and notarize the deed. ... File the documents in the county land records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.