Loading

Get Pension Plan Name

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pension Plan Name online

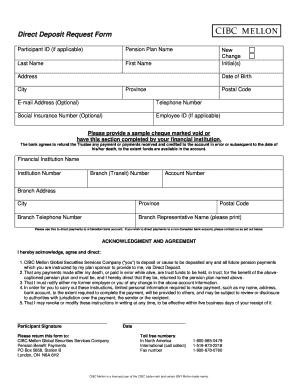

This guide provides a comprehensive overview of how to complete the Pension Plan Name online form effectively. Follow the detailed steps to ensure accuracy and compliance while providing the necessary information for direct deposit requests.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your participant ID in the designated field if applicable.

- Fill in the pension plan name. This should reflect the official title of the pension plan you are associated with.

- Provide your last name and first name in the appropriate fields.

- Indicate if this is a new request or a change by checking the corresponding box.

- Add your initial(s) if required.

- Enter your complete address including street, city, province, and postal code.

- Input your date of birth in the designated field.

- Provide your email address and telephone number; these fields are optional but recommended for communication.

- Fill in your social insurance number; this field is also optional but useful for verification.

- Include your employee ID if applicable.

- Attach a sample cheque marked void or ensure this section is completed by your financial institution.

- Enter your financial institution name, followed by the institution number and branch (transit) number.

- Provide your account number and the branch address, including city, province, and postal code.

- Indicate the branch telephone number and print the name of the branch representative.

- Carefully read the acknowledgment and agreement section, and ensure you understand the implications before signing.

- Sign and date the form at the specified locations.

- Return the completed form to CIBC Mellon Global Securities Services Company at the provided address.

- After completing the form, you can save changes, download, print, or share it as necessary.

Complete your documents online now for efficient processing.

Tier 3 is a “defined benefit” plan that provides pension benefits based upon final average pay and years of service. This plan provides service, disability and survivor pension benefits as well as retiree health insurance subsidies to eligible sworn members and certain qualified survivors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.