Loading

Get Au Leveraged S32396 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU Leveraged S32396 online

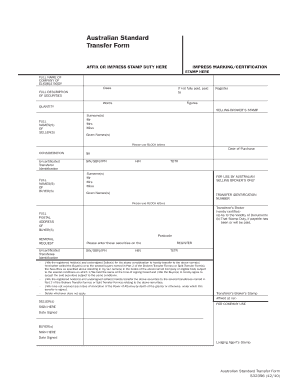

The AU Leveraged S32396 is an essential document for transferring securities in Australia. This guide aims to assist users in filling out the form accurately and efficiently, ensuring all necessary details are included for a successful submission.

Follow the steps to complete the AU Leveraged S32396 form online.

- Press the ‘Get Form’ button to access the AU Leveraged S32396 and open it in your preferred online editor.

- Begin by filling in the 'Full name of company of eligible body' section. Ensure that you use correct names as per legal documents.

- Identify the 'Full description of securities' and enter a detailed description of the securities being transferred.

- Input the 'Quantity' of securities you wish to transfer accurately.

- Complete the 'Full name(s) of seller(s)' section with the seller's full legal names, including surnames and given names, using block letters.

- In the 'Date of purchase' field, enter the exact date when the securities were purchased.

- Fill out the 'Consideration' amount in Australian dollars, specifying the agreed price for the transaction.

- If applicable, provide 'Uncertificated transferor identification' such as SIN, SBN, or IPN.

- Proceed to complete the 'Full name(s) of buyer(s)' section with the buyer's information in block letters.

- Include the 'Full postal address of buyer(s)' including postcode for any correspondence.

- Obtain the 'Selling broker’s stamp' which verifies the transaction and indicates compliance with regulations.

- Finally, ensure that the seller(s) and buyer(s) sign and date the form in the designated areas to validate the document.

- Once all fields are completed, save changes, and download or print the form for your records. You may also share it as needed.

Complete your AU Leveraged S32396 form online today for a seamless transfer experience.

You give shares to the Broker CM account and from there it goes to the clearing member and then to the final client DP account. Since these transactions are routed through a clearinghouse, they are an on-market transaction. Off market transfers are not routed through the clearinghouse.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.