Loading

Get Irs Schedule R (form 941) 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Schedule R (Form 941) online

Filling out IRS Schedule R (Form 941) online can seem daunting, but with clear instructions, you can navigate the process with confidence. This guide provides a step-by-step approach to completing the form accurately and efficiently.

Follow the steps to successfully complete Schedule R online.

- Click 'Get Form' button to obtain the form and open it in your preferred editing tool.

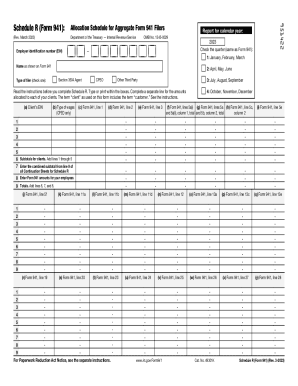

- Enter your employer identification number (EIN) in the designated field at the top of the form.

- Select the calendar year for which you are reporting by marking the appropriate box.

- Choose the relevant quarter. This should correspond to the same quarter checked on Form 941.

- Provide your name as it appears on Form 941 in the specified section.

- Indicate the type of filer by checking the appropriate box—CPEO or Other Third Party.

- For each of your clients, complete the sections as follows: enter their EIN, type of wages (if applicable), and the relevant figures from Form 941 in the correct columns.

- Proceed to calculate the subtotals for your clients by adding the numbers across lines 1 to 5.

- Transfer the combined subtotal from line 9 of any continuation sheets to line 7 of the main form.

- Fill in the amounts related to your employees from Form 941 on line 8.

- Calculate the total by adding lines 6, 7, and 8. Ensure accuracy to avoid discrepancies.

- Once all sections are complete and verified, you may save your changes, download the document, print it for your records, or share it as needed.

Begin completing your IRS Schedule R (Form 941) online today for a streamlined experience.

Go to .irs.gov/Form941 for instructions and the latest information. Read the separate instructions before you complete Form 941. Type or print within the boxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.