Loading

Get Slavic 401k Withdrawal

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Slavic 401k Withdrawal online

This guide offers a clear, step-by-step approach for filling out the Slavic 401k Withdrawal form online. Whether you are withdrawing for retirement or other purposes, this guide is designed to assist you in completing the necessary sections accurately and efficiently.

Follow the steps to complete your Slavic 401k Withdrawal form online.

- Click ‘Get Form’ button to access the Slavic 401k Withdrawal form.

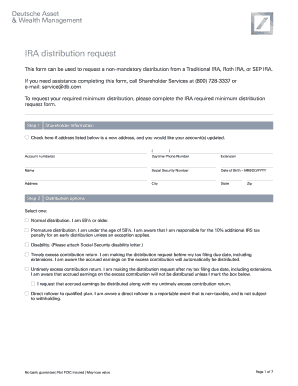

- Provide your personal details in the shareholder information section. Enter your account number(s), daytime phone number, full name, social security number, date of birth, and address details.

- Select your distribution option. Indicate whether you are taking a normal distribution, a premature distribution, a distribution due to disability, or one for excess contributions. Ensure to select the applicable options carefully.

- If requesting a one-time distribution, specify the details for each fund you wish to withdraw from. Enter either the dollar amount or the percentage for each fund indicated.

- If you choose to set up an automatic withdrawal plan, provide the desired start date, distribution frequency, and the relevant dollar amounts for each fund.

- Indicate your preferred payment method. Choose from options such as a check payable to you, a transfer to your bank account, or an investment into a non-IRA fund account, if applicable.

- Fill in the tax withholding information carefully. Review the options and select the federal and state withholding preferences that apply.

- Review the account owner authorization and complete the signature section. Ensure that any required signatures or guarantees are obtained, as specified.

- Finalize your form by ensuring all sections are completed. You may then save changes, download, print, or share the completed form as needed.

Complete your Slavic 401k Withdrawal form online today for a seamless experience.

The administrator will likely require you to provide evidence of the hardship, such as medical bills or a notice of eviction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.