Loading

Get Canada Gst489 E 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST489 E online

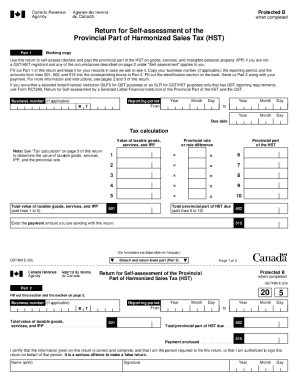

The Canada GST489 E is a return form for self-assessing the provincial part of the Harmonized Sales Tax (HST). This guide provides clear, step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to complete the Canada GST489 E online form.

- Use the 'Get Form' button to obtain the Canada GST489 E form and open it in your preferred online editor.

- Fill out Part 1 with the following details: your business number (if applicable), the reporting period start and end dates, and the total value of taxable goods, services, and intangible personal property (IPP). Make sure to calculate the total value by adding lines 1 to 5.

- For each province, enter the provincial rate or rate difference based on where goods or services were acquired. If applicable, calculate how the provincial rates apply.

- Complete the 'Tax calculation' section by filling in the taxable amounts and their corresponding provincial rates. The total provincial part of HST due will automatically populate based on your entries.

- Input the payment amount you are sending along with this return in the designated field for payment.

- Review your entries for accuracy before proceeding to Part 2. Make sure that all information is correct and complete.

- Fill out Part 2, which requires the same information as in Part 1. Ensure to complete the identification section, print your name, and sign the document.

- Detach Part 2 from the return and send it, along with your payment, to the Prince Edward Island Tax Centre.

- Finally, save changes to your online copy, download or print a copy for your records, and share it as needed.

Complete the Canada GST489 E form online today to ensure compliance with your HST obligations.

Form RC158, Remittance Voucher Payment on Filing Use Form RC158 to send a payment along with a return. Form RC158 will show the tax year-end. You have to enter the amount you are paying in the "Amount paid" box.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.