Loading

Get Tx Valic Non-erisa Loan Application 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX VALIC Non-ERISA Loan Application online

This guide provides users with a comprehensive set of instructions on how to effectively complete the TX VALIC Non-ERISA Loan Application online. By following these steps, users can ensure they accurately fill out the application and understand its components.

Follow the steps to complete your application seamlessly.

- Use the ‘Get Form’ button to access the TX VALIC Non-ERISA Loan Application and open it in the online editor.

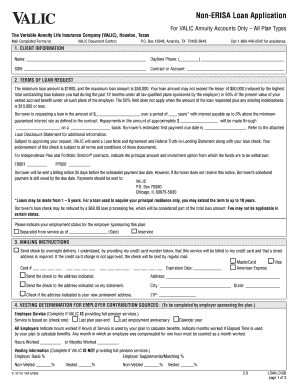

- Begin by filling out the Client Information section. Include your full name, daytime phone number, Social Security Number (SSN), and your contract or account number.

- In the Terms of Loan Request section, indicate the amount you are requesting. Ensure that it falls within the allowed limits, and specify the duration of the loan. Note the estimated first payment due date and how repayments will be made.

- Complete the Mailing Instructions section. Choose whether to send the check by overnight delivery or to the indicated address. If you select overnight delivery, provide credit card information for the service.

- If applicable, have your employer complete the Vesting Determination for Employer Contribution Sources section. This may require hours or months worked and vesting information.

- If your plan requires it, complete the Plan Administrator Approval section, which includes the name and signature of your plan administrator.

- Fill out the Security and Approval for Loan section where you certify your understanding of the loan's terms and conditions. Ensure you provide your signature and date.

- Once all fields are completed, save your changes. You can then download, print, or share the completed form as needed.

Start completing your TX VALIC Non-ERISA Loan Application online today!

If you are under age 59½, you will have to pay the 10% federal early withdrawal penalty for any taxable payment from an employer plan (including amounts withheld for income tax) that you do not roll over, unless one of the exceptions listed below applies.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.