Loading

Get Hamp Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hamp Application Form online

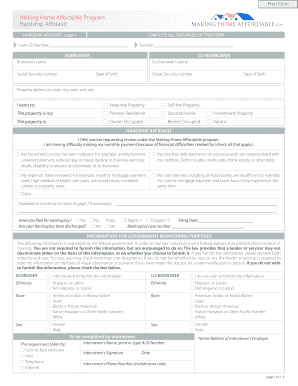

The Hamp Application Form is a key document for homeowners seeking assistance under the Making Home Affordable Program. This guide provides clear instructions on how to complete the form online, ensuring a smooth submission process.

Follow the steps to fill out the Hamp Application Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the first section by entering your Loan I.D. Number and the name of your Servicer. Ensure that all information is accurate.

- Provide personal information such as the Borrower and Co-borrower’s names, Social Security numbers, and dates of birth. This information is essential for identification.

- Indicate the property address, including the city, state, and zip code. Specify your intentions for the property, choosing from options like 'Keep the Property', 'Sell the Property', and denote the type of residence.

- Complete the hardship affidavit by checking all applicable boxes that describe your financial difficulties, and provide an explanation if necessary.

- Answer the bankruptcy questions accurately, including details about any filing; this is vital for understanding your financial situation.

- For government monitoring purposes, decide whether to furnish your demographic information; while it is optional, providing it can help with compliance monitoring.

- Carefully read and acknowledge the agreement and signature section. Ensure all statements are true, as providing false information can lead to serious consequences.

- Finish by signing and dating the form for both the Borrower and Co-borrower as required. After completing these steps, you can save your changes, download the form, print it, or share it.

Complete your Hamp Application Form online today to access the support you need.

The Fannie Mae Flex Modification offers eligible homeowners mortgage payment relief by extending the term to 480 months and targeting a 20% principal and interest reduction. The modification may also result in a lower interest rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.