Loading

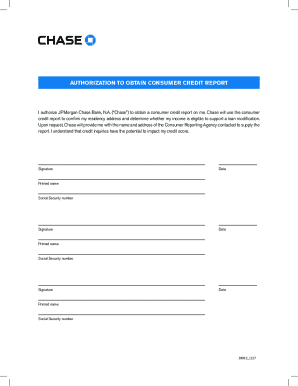

Get Chase Authorization To Obtain Consumer Credit Report 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chase Authorization To Obtain Consumer Credit Report online

Filling out the Chase Authorization To Obtain Consumer Credit Report form is an important step in facilitating your loan modification process. This guide will provide you with clear, step-by-step instructions to complete the form effectively.

Follow the steps to successfully complete and submit the form.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by filling in your printed name in the designated field to clearly identify yourself.

- Next, enter your Social Security number in the appropriate section. This information is essential for the identification process.

- Sign the form in the signature field. This authorization is crucial for Chase to obtain your consumer credit report.

- Indicate the date of signing the form to confirm when you provided your authorization.

- If there are additional signers, repeat the process for each individual: provide their printed name, Social Security number, signature, and date.

- Once you have completed all required sections, review the form to ensure all information is accurate and complete.

- Finally, you can save your changes, download the document for personal records, print it for submission, or share it as needed.

Complete your documentation online today to streamline your loan modification process.

They do this to evaluate your risk as a consumer and to gain insight into your past financial dealings. In these cases, most entities are required to ask for your permission before pulling your credit reports.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.