Loading

Get Irs 656-b 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 656-B online

The IRS Form 656-B is an important document for individuals seeking to settle their tax liabilities through an Offer in Compromise. This guide provides a clear and supportive overview of how to complete the form online, ensuring that you can navigate each section effectively.

Follow the steps to successfully complete your IRS 656-B online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

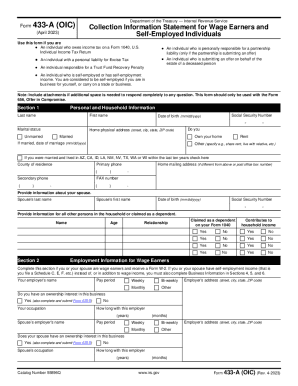

- Begin by filling out your personal information section. Provide your full name, Social Security Number, and address accurately to avoid any issues.

- Complete the 'Individual Tax Periods' section, checking all applicable tax years or types related to your Offer in Compromise.

- Select your reason for submitting the offer in 'Reason for Offer.' Ensure that you clarify any special circumstances that justify the amount you are offering.

- Specify your payment terms. Choose between 'Lump Sum Cash' or 'Periodic Payment' options, and fill out the required details accordingly.

- Designate your payments. Indicate the tax years you want your payments applied to, ensuring clear communication of how you want the funds allocated.

- Review all the information you entered in each section to ensure accuracy. It's crucial to confirm that the figures align and the necessary fields are completed.

- Once you’ve checked everything, save your changes. You can then download, print, or share the completed form as needed.

Complete your IRS 656-B online today to start your tax resolution process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

For taxpayers facing a hefty tax bill, the IRS offers an option through its Debt Forgiveness program. However, it's essential to know the IRS grants debt forgiveness in rare cases, usually for those in extreme financial hardships.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.