Loading

Get Tax Return Formsestonian Tax And Customs Board

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Return Forms Estonian Tax And Customs Board online

Filing tax returns can often seem daunting, especially for those unfamiliar with the process. This guide provides clear, step-by-step instructions on how to complete the Tax Return Forms for the Estonian Tax And Customs Board online, ensuring you can submit your information accurately and efficiently.

Follow the steps to successfully complete your Tax Return Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

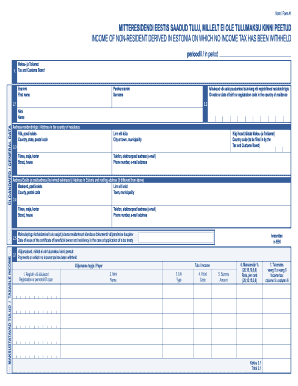

- Begin by filling in your personal information in the General Data section. Enter your first name, surname, and ID-code, or your date of birth if the ID-code is not available. Provide your address in the country of residence, including the country, postal code, street, city, and any relevant contact information such as your phone number and email address.

- Next, navigate to the Taxable Income section. Specify the date of issue of the certificate proving your residency if applicable. List all payments received on which no income tax has been withheld. For each entry, provide the necessary details, including the payer's registration or personal ID code, name, type, and amount.

- Continue by calculating the income tax for each payment listed. Apply the appropriate tax rate to determine the income tax due from each amount received. Sum up total amounts in the designated fields.

- In the Confirmation section, affirm that all information provided is accurate. You or your representative must sign and date this section to validate the submission.

- Review all entries carefully for errors or omissions, ensuring that all required fields are completed. After confirming that everything is correct, proceed to save your changes, download a copy for your records, or share the form as needed.

Complete your tax return forms online today to ensure timely and accurate submission!

You can use the 1040 to report all types of income, deductions, and credits. You may have received a Form 1040A or 1040EZ in the mail because of the return you filed last year. If your situation has changed this year, it may be to your advantage to file a Form 1040 instead.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.