Loading

Get Alabama Form Int 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alabama Form Int 2 online

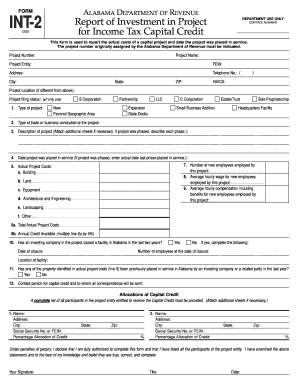

The Alabama Form Int 2 is essential for reporting investment in a qualifying capital project for income tax capital credit. This guide provides detailed, step-by-step instructions to assist users in accurately completing this form online.

Follow the steps to effectively fill out the Alabama Form Int 2 online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the project number assigned by the Alabama Department of Revenue. This number is critical for all future correspondence regarding the project.

- Provide the project name, which may be an internal identifier for the capital project.

- Complete the project entity section by entering the name of the entity qualifying for the capital credit.

- Fill in the FEIN (Federal Employer Identification Number), the mailing address, city, state, and ZIP code for the entity.

- If the project location differs from the above address, input that information in the project location section.

- Lock in the appropriate project filing status by checking the relevant box that describes the type of project.

- Briefly describe the type of trade or business conducted at the project.

- Offer a comprehensive description of the project. If necessary, attach additional sheets for more details.

- Enter the date when the project was placed in service, which is vital for determining the capital credit eligibility.

- State the actual project costs in specified categories (building, land, equipment, etc.).

- Calculate the total actual project costs and the annual credit available by multiplying the total by 5%.

- Record the number of new employees employed by this project.

- Input the average hourly wage and average hourly compensation for new employees at the project.

- Answer the questions regarding the closure of any previous facilities in Alabama and provide the necessary details.

- Identify the contact person for capital credit and fill out their details.

- List all participants in the project entity entitled to receive the capital credit, including their details and percentage allocation.

- Review the form for accuracy before saving your changes, downloading, printing, or sharing the completed form.

Complete your Alabama Form Int 2 online today to ensure you can claim your income tax capital credit!

Nonresidents must file a return if their Alabama income exceeds the allowable prorated personal exemption. Part year residents whose filing status is “Single” must file if gross income for the year is at least $4,000 while an Alabama resident.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.