Loading

Get Bt 1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bt 1 Form online

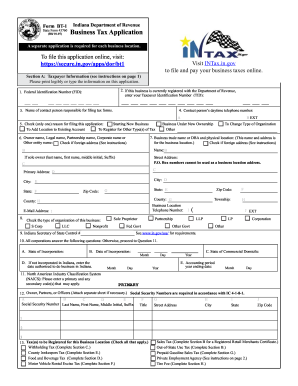

Filling out the Bt 1 Form online can streamline the process of registering your business for tax purposes. This guide provides step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete the Bt 1 Form online.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Enter your taxpayer information in Section A. Provide your Taxpayer Identification Number (TIN) and ensure that the information corresponds with the records held by the Indiana Department of Revenue.

- Complete all relevant sections concerning your business type and operations. You will need to specify the nature of your business, such as retail, food services, or manufacturing, and select the appropriate tax types you wish to register for.

- Fill out the contact person details in Section A. This includes the name, phone number, and any additional relevant information.

- Review the information you have entered to ensure it is complete and correct. Make any necessary corrections at this stage.

- Once the form is completed and verified, you can save your changes. You may have options to download, print, or share the form directly from the editor.

Begin completing the Bt 1 Form online to get your business registered today.

Find forms online at our Indiana tax forms website, order by phone, at 317-615-2581 (leave your order on voice mail, available 24 hours a day). Find federal tax forms from the Internal Revenue Service online, or call 1-800-829-3676.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.